Japan is one of the world’s largest economies, with a GDP exceeding $4 trillion and high per-capita purchasing power. Its thriving consumer base, strong cultural identity, and preference for native-language communication make Japanese localization an essential strategy for any company aiming to grow in this market.

However, many businesses mistake simple translation for true localization, overlooking the complex cultural and technical considerations that successful market entry demands. As such, before diving into its value, we must first define what we mean by “localization.”

What is Japanese localization?

Japanese localization refers to adapting content, products, and services to suit the Japanese market’s language, culture, and technological preferences. It ensures that the message, product, or service resonates with local audiences.

On the other hand, translation is a more straightforward process that focuses solely on converting text from the source language into the target language. While it ensures linguistic accuracy, it does not account for cultural nuances, local preferences, or contextual adaptations.

With these definitions in mind, it’s clear that localization is a more comprehensive approach than translation alone. However, its value needs to be addressed.

Why is Japanese localization important?

Japanese localization is important primarily because it improves the accessibility of a product or service, thus increasing its marketability.

This enhanced accessibility manifests through five key factors that make localization a critical business investment:

- Purchase behavior: Properly localized materials significantly increase purchase intent among Japanese customers.

- Language accessibility: Japan’s historically limited exposure to English creates an environment where native language content is essential for effective communication.

- Cultural resonance: Strong cultural preferences in Japan demand market-specific adaptation strategies.

- Regulatory compliance: Strict regulatory requirements mandate accurate translation and localization of business materials.

- Market access: Japan’s large consumer base means localization can dramatically expand your product’s accessibility to millions of potential users.

Let’s explore each of these in detail.

1. Increased purchasing behavior

An iconic survey by CSA Research titled “Can’t Read Won’t Buy” revealed key insights on the value of localization as a whole, including Japanese localization. According to their findings:

- 40% of consumers won’t buy a product in a non-native language.

- 65% of consumers prefer content in their language.

- 73% want product reviews in their language.

Consequently, consumers across industries will engage with products and services more effectively once they are localized.

2. Language accessibility

Japanese consumers tend to engage more comfortably with content in their native language. According to a 2018 EF Education First survey, only 18% of people in Japan felt confident speaking English, while 25% could understand basic phrases but lacked the confidence to converse.

Even in 2024, Japan ranked 92nd globally for English proficiency, highlighting localization’s importance in ensuring effective engagement with products and services.

3. Cultural resonance

Japanese consumers have high cultural awareness, and marketing materials that do not respect local customs or cultural sensitivities can damage a brand’s reputation.

This was powerfully illustrated when Valentino, the Italian luxury brand, faced significant backlash over a 2024 campaign featuring model Mitsuki Kimura (Koki).

The advertisement showed Kimura wearing heels while standing on fabric that resembled an obi—a traditional kimono sash. Japanese social media erupted with criticism, as placing shoes on or near items of cultural significance is considered deeply disrespectful in Japanese culture.

The incident forced Valentino to remove the campaign and issue a formal apology, demonstrating how even major global brands can stumble when they fail to understand Japanese cultural nuances properly.

4. Regulatory compliance

The Consumer Affairs Agency (CAA) and advertising laws require companies to substantiate any claims with evidence and present important information—such as prices, terms, and risks—clearly and understandably, often in Japanese.

Failure to comply with these regulations, including neglecting localization, can result in consumer mistrust and legal issues.

5. Market access

While Japan slipped to the world’s fourth-largest economy in 2024, it remains one of the most robust and influential markets globally. Boasting a GDP of $4 trillion and a strong purchasing power of $53.06 thousand per capita, it remains an ideal destination for any major organization looking to expand its reach.

In our view, the value of Japanese localization is undeniable. However, to fully unlock its potential, it is crucial to navigate the intricacies of the language and the localization process itself.

Missteps in this area can alienate local consumers rather than win them over. With this in mind, let’s explore some of the most common challenges and how to address them effectively.

The five Japanese localization challenges

Japanese localization challenges present unique hurdles that can significantly impact project success and market entry. From the complexity of multiple writing systems to intricate cultural nuances, localizing content for the Japanese market requires careful planning and expertise.

1. Understanding the Japanese writing system

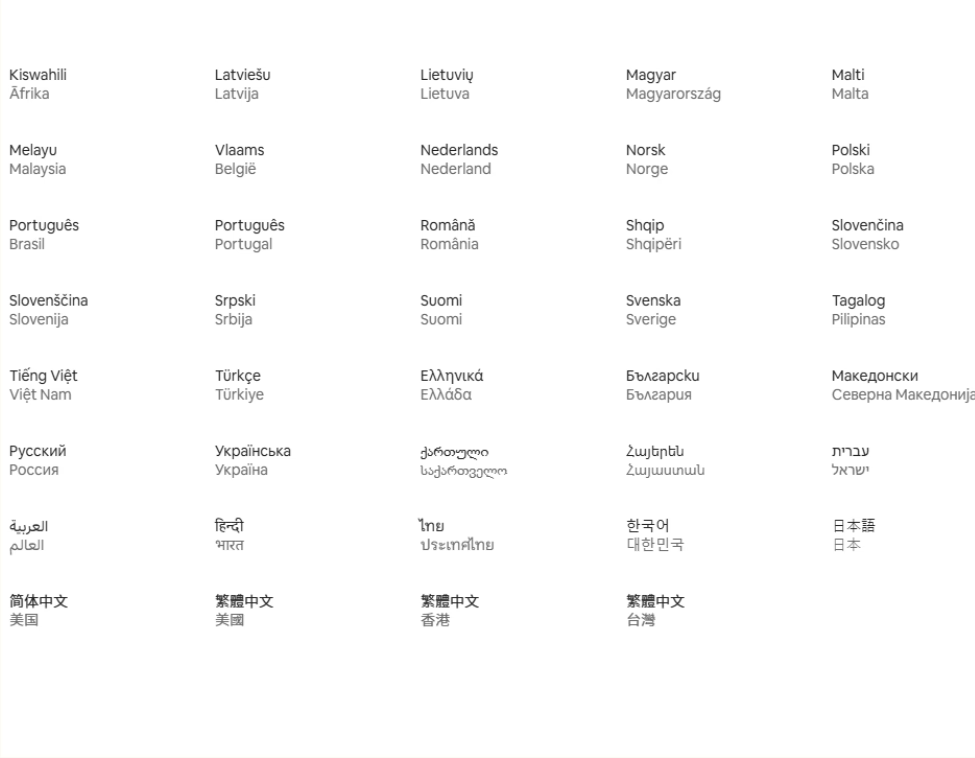

Japanese uses three writing systems: Kanji (Chinese characters), Hiragana, and Katakana. This unique combination creates specific challenges for localization projects.

Kanji characters represent concepts and can have multiple “readings.” For example, the character “山” (mountain) can be read as either “san” or “yama” depending on context. This complexity means that text-to-speech systems, OCR software, and machine translation tools require sophisticated programming to handle Japanese content correctly.

Hiragana is a phonetic alphabet with smooth, curved characters used for native Japanese words and grammar elements. It’s essential for making text readable and accessible, often appearing alongside Kanji to indicate proper pronunciation.

Katakana, another phonetic alphabet with angular characters, is primarily used for foreign words and brand names. When localizing into Japanese, your company or product name will likely be written in Katakana, requiring careful consideration of how it sounds when converted to Japanese phonetics.

This complex writing system means that Japanese text typically requires more sophisticated font support, larger character sets, and careful attention to proper character rendering. Additionally, the mix of writing systems can affect text layout, as different scripts may need different amounts of space and line heights for optimal readability.

2. Navigating unique linguistic feature

One of the sources of Japanese localization challenges is due to the inherent linguistic properties of the language. For instance, its grammar differs fundamentally from English, following a subject-object-verb (SOV) structure rather than English’s subject-verb-object (SVO) order:

- English: I like playing games.

- Japanese: ゲームをするのが好きです (“Game play like”).

- English: I discovered a treasure chest.

- Japanese: 宝箱を発見した (“Treasure chest discovered”).

This structural difference means automated translation tools often struggle with Japanese, and content may need significant restructuring during localization to maintain natural flow and meaning.

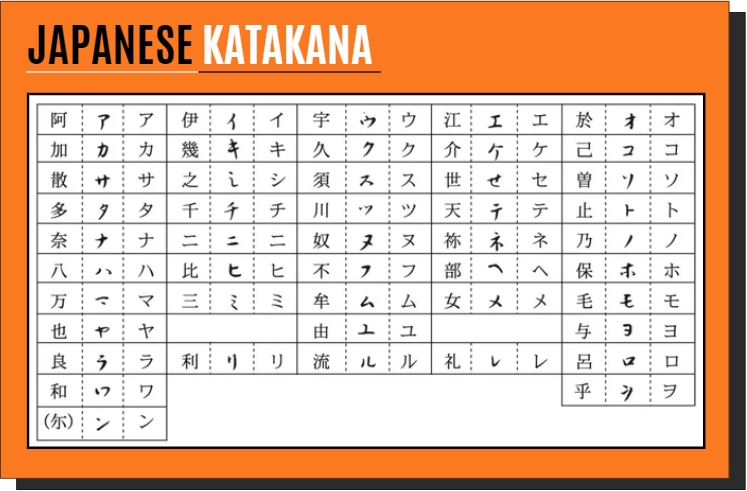

Furthermore, the Japanese language incorporates distinct speaking styles based on gender and social context.

Gendered language styles

- Male-coded language (だんせいようご,男性用語): It uses direct, assertive expressions with specific pronouns like “俺 (ore)” or “僕 (boku)” for “I.” Sentence endings like “だ,” “ぜ,” or “ぞ” add strength to the tone.

- Female-coded language (じょせいようご,女性用語): It employs softer, more polite expressions using pronouns like “私 (watashi)” or “あたし (atashi)” for “I.” Sentence endings like “わ,” “のよ,” or “かしら” create a gentler feel.

These differences are important from a localization perspective. The wrong sentence structure can affect how characters are perceived.

Politeness levels (teinei 丁寧)

Japanese business communication operates on multiple politeness levels that reflect social status and relationships.

- Polite form: 敬体 (けいたい/keitai)

尊敬語 (そんけいご/sonkeigo): For showing respect

謙譲語 (けんじょうご/kenjōgo): For self-deprecation and elevating others

丁寧語 (ていねいご/teineigo): Standard polite forms using “です” (desu) or “ます” (masu)

- Casual form: 简体 (けんたい/kentai)

It is used for daily communication, and its more natural and casual tone is suitable for occasions between family, friends, or peers.

These linguistic features affect:

- Marketing materials and brand voice

- Customer service scripts

- User interface text

- Character dialogue in games and media

- Internal business communications

When localizing content to Japanese, maintaining appropriate gender language and politeness levels requires careful consideration of the target audience and context. This often necessitates native speaker review to ensure cultural appropriateness and natural flow.

3. Implementing cultural adaptation

Cultural adaptation is often more challenging than linguistic translation in Japanese localization. Western concepts, humor, and idioms frequently need complete reimagining to resonate with Japanese audiences.

This challenge is particularly obvious in the gaming industry, where player immersion depends heavily on natural-feeling dialogue and cultural authenticity.

Consider how the Japanese localizers of The Last of Us handled this challenge. When localizing casual praise like “You’re a natural,” the team chose “お前、才能あるな” (Omae, sainou aru na / “You have talent”) rather than attempting a direct translation.

This choice reflects Japanese communication patterns, where explicit statements about ability are more common than the metaphorical expressions often used in English.

Such careful cultural adaptation ensures that players remain immersed in the game world without being jolted out of the experience by awkward or unnatural localization.

This principle applies to all forms of content localization—from marketing materials to user interfaces—where success depends on making the content feel native rather than translated.

4. Managing text length and space

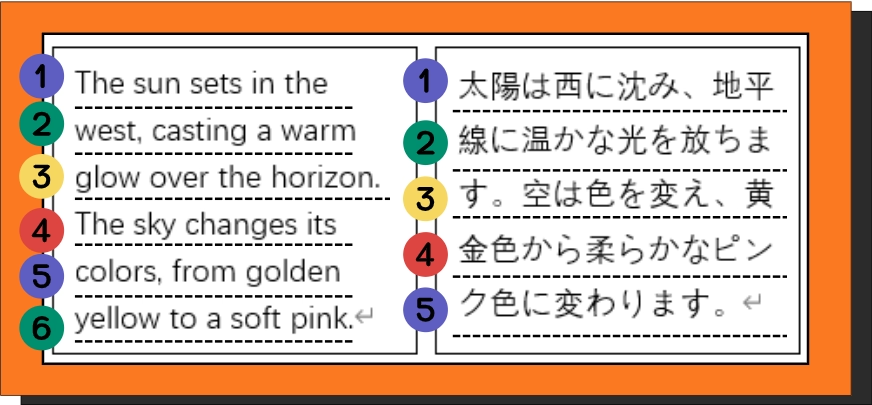

Japanese localization presents unique challenges regarding text length and spacing requirements, particularly affecting user interface design.

Variable text length

Despite Japanese often being more conceptually concise, translated text can require significantly more space than English:

This variation happens because:

- Japanese uses double-byte characters, needing more data storage

- Certain English concepts need longer explanatory phrases in Japanese

- Technical terms often expand when converted to katakana

Layout consideration

This issue is particularly relevant for Japanese software localization or similar endeavors. For clarity, Japanese text requires larger line spacing, and developers must account for character height variations between scripts.

Text containers need to be flexible enough to handle dramatic length changes, and certain content types may benefit from vertical text layouts, which are common in Japanese interfaces.

These factors make it crucial to plan for text expansion and spacing requirements early in the development process, particularly for user interfaces and mobile applications where space is limited.

5. Resolving terminology issues

Technical terminology presents unique challenges when localizing into Japanese, particularly regarding choice of expression and consistency across materials.

Many technical terms can be expressed in multiple ways in Japanese. For instance, “supply chain” is commonly translated as “サプライチェーン” (sapuraichēn) in katakana, a phonetic transliteration widely used in everyday Japanese.

However, some commonly used terms in Japan may not be primarily written in katakana as loanwords but in kanji. For instance, “asset management” is written as “アセットマネジメント” (asetto manejimento) in katakana (phonetic transliteration), but the more common expression in Japan is “資産管理” (shisan kanri), which uses kanji.

The choice between these options depends on industry standards, target audience, and context. Financial professionals might prefer the native term, while marketing materials might use the phonetic version to appear more modern or international.

Consistency becomes particularly crucial in technical documentation and user interfaces. Terms like “API” have multiple accepted translations in Japanese—from the full “アプリケーション プログラミング インターフェース” (Apurikēshon Puroguramingu Intāfēsu) to abbreviations like “アピ (Api)、エーピーアイ (Ē Pī Ai)”

Organizations must establish and maintain glossaries to ensure consistent terminology usage across all materials, from documentation to marketing content.

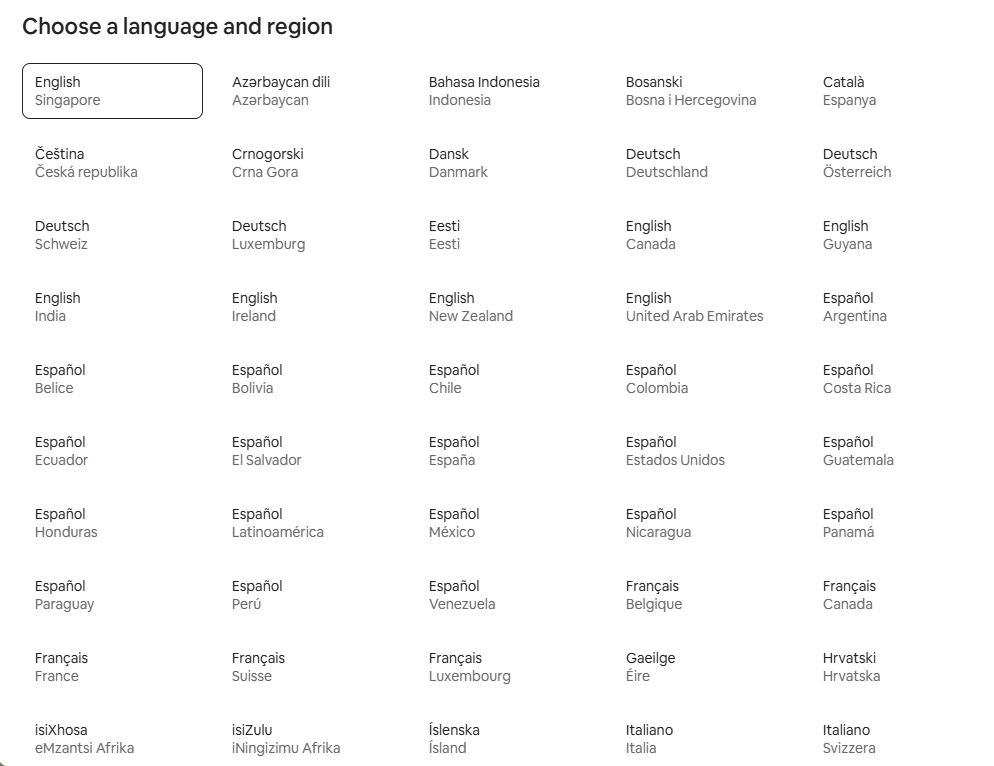

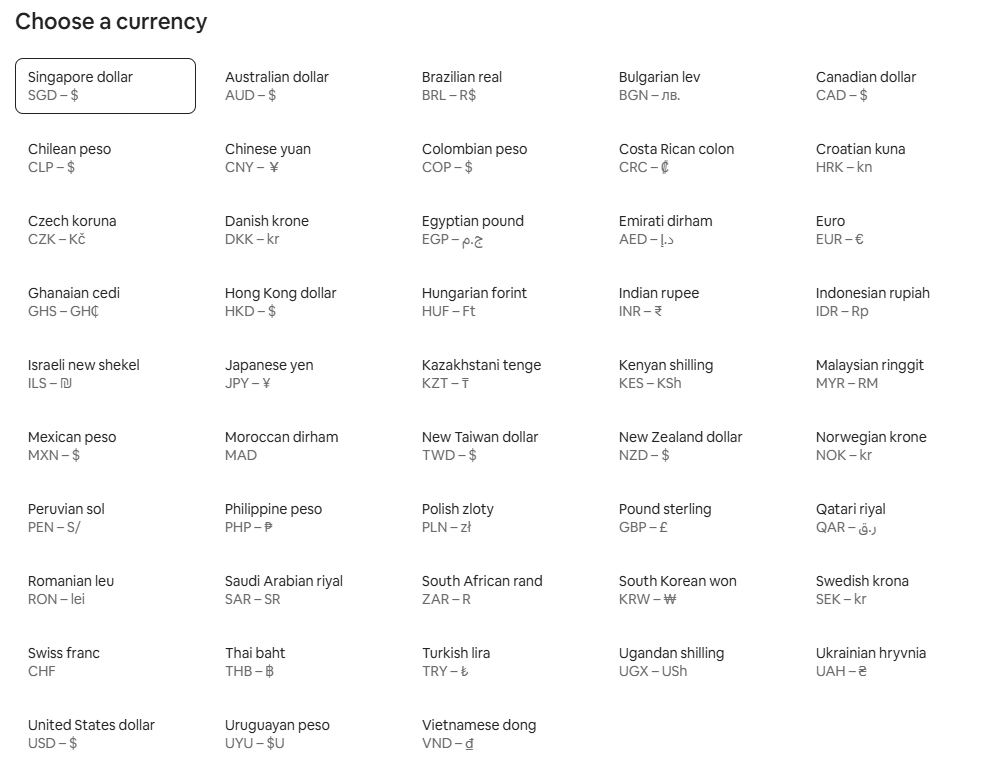

Japanese localization examples: Airbnb

Airbnb’s commitment to great localization is particularly evident in its Japanese operations. To better cater to local consumers, the company started by adapting its brand name to “エアビーアンドビー” or “エアビー” (Airbee), maximizing familiarity and accessibility.

Furthermore, its Japanese website localization went beyond just matching the local culture with appropriate currency and date formats—it was part of a comprehensive strategy.

To comply with Japan’s home-sharing regulations, Airbnb developed a specialized partnership ecosystem. They established three categories:

- Demand partners for loyalty programs and airline miles

- Service partners for host support and property management

- Supply partners to ensure high-quality listings

The system aims to help new hosts quickly list their properties and make it easier for guests to find great places to stay.

The results speak for themselves: Airbnb has seen a 32% year-over-year increase in overnight stays outside major cities, while cities like Tokyo, Nagoya, and Osaka have experienced significant spending growth.

Their partnerships with local governments, including Kushiro City in Hokkaido and Sado City in Niigata Prefecture, have helped revitalize local communities and repurpose vacant properties. In just the first half of 2024, over 1,270 new cities and towns listed their first Airbnb accommodations—the highest number since the company entered Japan.

Yasuyuki Tanabe, Airbnb’s Country Manager in Japan, emphasizes the company’s commitment to working with government authorities on clear home-sharing regulations, positioning Japan as a leader in the sharing economy.

This collaborative approach, combined with their multilingual customer support and locally adapted payment systems, has helped Airbnb build trust with Japanese users and hosts alike.

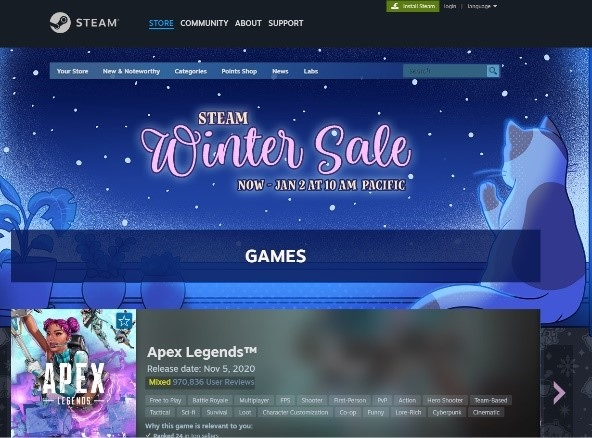

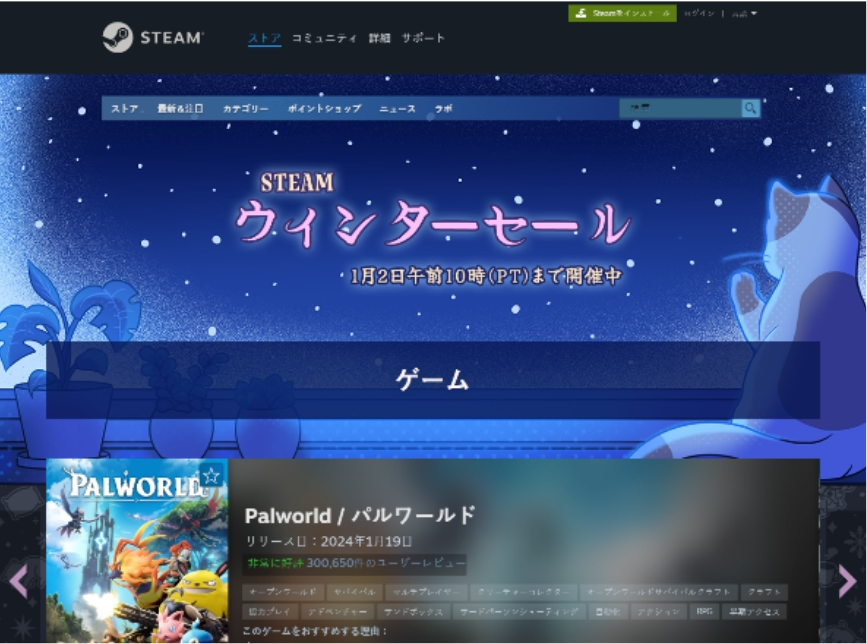

Japanese localization examples: Steam

Steam’s success in Japan represents a significant shift in the traditionally console-dominated gaming market. Its comprehensive localization strategy has helped drive remarkable growth: the Japanese PC gaming market grew by 25% in 2023, and Japan’s Steam user base has increased by more than 150% since 2019, surpassing German and French user populations.

As of December 2024, Japanese represents the eighth-largest language group on Steam, accounting for 2.53% of users.

Steam’s approach goes beyond simple translation. It invested heavily in local infrastructure, ensuring fast server connections for Japanese users, and implemented region-appropriate payment methods and pricing.

The platform’s recommendation system is particularly noteworthy—the Japanese version of Steam’s homepage offers carefully curated game suggestions that align with local gaming preferences.

According to Erik Gerber, speaking at Nordic Game 2024, this success is part of Steam’s broader mission to reach gamers worldwide. Their investment in regional infrastructure and payment systems has yielded similar results across Asia, with countries like China, India, and the Philippines seeing substantial user growth.

Key takeaways

- Japanese is a unique language with a rich cultural and linguistic history, requiring careful consideration in localization to connect with local audiences.

- With over 123 million consumers and a $4.07 trillion GDP in 2024, Japan offers significant opportunities, especially in gaming, healthcare, and technology.

- Japanese consumers strongly prefer native-language content, making effective localization crucial for building trust and driving purchases.

- The main Japanese localization challenges you have to overcome are due to cultural differences, text length differences, and industry-specific terminology.

- Success stories like Airbnb and Steam showcase the value of tailored localization.

By addressing these aspects, you can unlock the potential of the Japanese market and create meaningful connections with its consumers.