Summary: Japanese game localization opens doors to at least 58 million Japanese-speaking gamers worldwide. These gamers boast one of the highest ARPUs worldwide, projected to reach $1,750 in 2025. In fact, Japan’s market alone generated $24 billion in revenue in 2024.

As such, leveraging game localization services effectively enables game developers, big and small, to improve the accessibility of their games, thus penetrating this lucrative segment more effectively.

The Asian gaming market presents enormous opportunities and unique challenges for developers looking to expand globally. While China’s massive player base often dominates the conversation, other regional markets offer compelling advantages—Japan stands out among these.

And yet, with the rise of other major languages, developers must carefully consider where to focus their localization efforts. As such, we aim to equip you with the necessary understanding to assess the value of Japanese localization and its potential impact on your game’s success.

We’ll explore the following questions:

- What is Japanese?

- How many people speak it?

- How many Japanese-speaking gamers are there?

- The Japanese market analysis

- Why is Japanese game localization necessary?

- The challenges in Japanese game localization

What is Japanese?

Japanese is a language with no clear origin. Several sources attempt to classify it, but it is not considered a settled matter and is subject to debate.

Some linguists argue that Japanese is part of the Altaic language family and shares grammatical similarities with Korean, Turkish, and Mongolian languages.

Others argue that Japanese is connected to Austronesian languages because of its shared phonetic features. This suggests that Japanese may have a mixed origin, combining Austronesian vocabulary and Altaic grammar.

Another classification argues that it is linked to ancient languages such as Old Goguryeo, which influenced the Korean Peninsula. Finally, some experts consider Japanese a completely isolated language within the Japonic family.

Classification aside, Japanese is spoken almost exclusively in Japan. It is not an official or second language in any other country.

How many people speak Japanese?

There are roughly 130.6 to 131.3 million Japanese speakers worldwide. However, this number depends on how they are classified. Broadly speaking, they can be categorized as native and non-native speakers.

Japanese native speakers

There are 123.4 million native Japanese speakers, according to WorldData. That’s roughly 99.1% of Japan’s population!

On the other hand, a second estimate based on the latest population census by Japan’s National Statistics Bureau shows a slightly lower number of native speakers, 122.7 million.

📃 Because of its declining population for 13 consecutive years, we can safely expect the native population of Japanese speakers to decrease. For reference, in 2023, the population decreased by 0.48%.

Japanese diaspora

There are approximately 4 million migrant Japanese native speakers. The largest communities reside in Brazil (2 million) and the United States (1.55 million).

Non-native Japanese speakers

There are about 3.85 million non-native Japanese speakers worldwide. This number is expected to grow due to the influence of Japanese culture in areas like anime, video games, and technology.

Most Japanese learners live in Asia-Pacific, in countries such as China, South Korea, Indonesia, and Australia.

Interestingly, Japanese is one of the few languages where, even though the number of native speakers is declining, the learning community is growing rapidly. In fact, Japanese is the fifth most popular language in the world.

How many Japanese-speaking gamers are there?

In 2023, there were approximately 55.53 million Japanese gamers. According to the Famitsu Game White Paper 2024 published by the Kadokawa ASCII Research Institute, it represents a 2.8% growth rate from 2022.

Furthermore, approximately 0.58 million Japanese gamers live abroad, primarily in the U.S., Brazil, and Australia. Coupled with the thriving Japanese learning culture, we estimate the total number of worldwide Japanese-speaking gamers to be at least 58 million in 2024.

It’s worth noting that the overwhelming majority of Japanese-speaking gamers reside in Japan. As such, the necessary market analysis becomes remarkably straightforward. We can focus exclusively on Japan to understand the value of Japanese game localization.

The Japanese market

Japan stands as the world’s third-largest gaming market after China and the United States, generating approximately $24 billion in 2024. This strength is particularly evident in mobile gaming, where Japanese gamers rank among the world’s biggest spenders with an average revenue per user (ARPU) of $1,750.

These numbers show that Japan isn’t just a large market—it’s a gaming powerhouse.

The Japanese gamer

To gain a comprehensive understanding of the Japanese gamer and their likelihood of engaging with your game, it’s essential to analyze their profile, platform preferences, genre interests, playtime habits, and spending capacity.

Age and gender

In terms of gender, 57% of Japanese mobile gamers are male, and 43% are female. According to Statista, this trend holds across other platforms, where at least 37% of male internet users and 25% of female internet users play online games, and this proportion has been continuously growing in recent years.

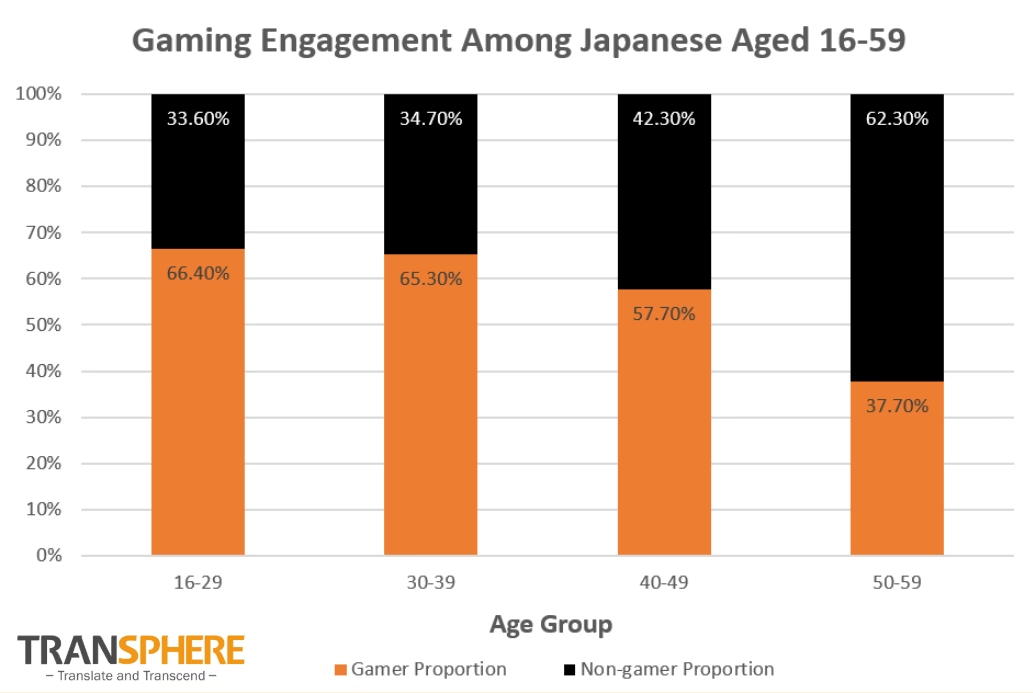

Regarding age distribution, the gaming penetration rate is highest among the 16-29 age group, reaching 66%, followed closely by those in their 30s (65%) and 40s (58%). Excluding the 50-60 age group, over half of the people in other age groups are gaming enthusiasts.

Platform preferences

Mobile games are the most popular platform overall, capturing approximately 47% of users, with the 15-24 age group forming the primary user base. On the other hand, console games are the second most popular category, followed by PC games.

A survey by the Z.com Engagement Lab revealed that around 56% of respondents play games on at least one device, with male players slightly edging out female players at 58% and 54%, respectively.

Additionally, according to Statista, 62.3% of Japanese teenage internet users engage in online gaming, with more than half of respondents under 30 being active online game players.

Gaming time and genres

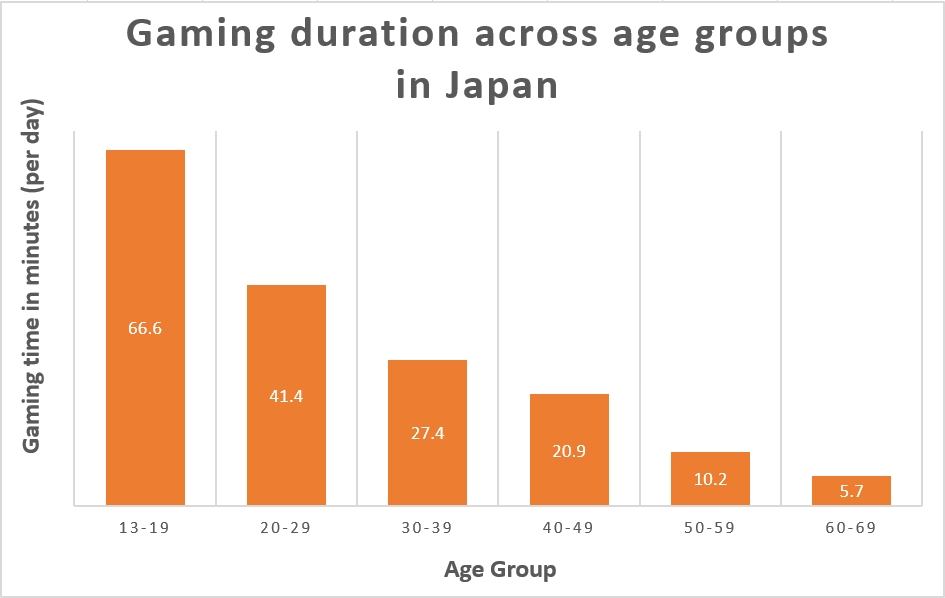

Japan holds the global record for average continuous gaming time at 5.33 hours. In 2023, teenagers spent over 66 minutes daily on online and social games, while older age groups spent less time gaming.

Although fewer women play games than men in Japan, female gamers are passionate about them. According to Newzoo, 54% of female gamers play five or more sessions weekly, compared to 44% of males. Female players also invest heavily in their favorite characters and events, displaying remarkable commitment and patience.

Regarding genres, role-playing games (RPGs) are the most popular, particularly among male players aged 30-59, while shooting games are comparatively less favored. However, younger male gamers under 29 increasingly gravitate toward action games, signaling a preference shift.

On the other hand, female players strongly prefer puzzle (PUZ) games across all age groups, with RPGs ranking as a close second for women aged 30-49.

Overall, Japanese players generally favor games with high freedom and immersive storytelling over competitive or social games. As such, the Japanese gamer profile indicates an increased sensitivity to Japanese game localization.

Sales data

We can categorize sales data into two broad categories: hardware and software sales.

Hardware sales

Mobile

Mobiles are the most popular gaming devices, with 57.9 million players. From casual puzzles to competitive shooters like PUBG, these games appeal to all age groups. Free-to-play games like “Genshin Impact” generate significant revenue in Japan, over $100 million monthly from in-app purchases (IAP).

Consoles

Consoles are the second most used platform, with 39.4 million players. In 2023, Sony’s PlayStation global sales reached over $8 billion, with 21.8 million PS5 units sold. The Nintendo Switch, which has sold over 100 million units as of 2024, is more popular than Sony in Japan as of 2021.

PC

PC gaming has become the third-largest platform, with 26.2 million users. Although it contributes only 7% to Japan’s gaming market, it has grown rapidly since 2019. The PC gaming market was valued at $1.61 billion in 2023, marking an 187.5% growth from 2019.

Software sales

Game sales

According to Kadokawa ASCII’s Famitsu Game White Paper 2023, Japan’s gaming market 2023 was up by 4.6% from the previous year, driven mainly by high PS5 and Nintendo Switch console sales.

The software sales for home consoles in 2023 amounted to $2.71 billion, accounting for 13.7% of the online gaming market. The online gaming market in Japan reached $12.05 billion in 2023, a 3.9% increase from the previous year.

Despite mobile games holding 71% of the market share, PC games showed a 24.9% growth, contributing 14.5% to the total online content market share.

In-app purchases (IAP)

From January to August 2023, in-app purchases (IAP) exceeded $9 billion, accounting for 18% of global revenue. In fact, Japan’s revenue per download (RPD) is four times higher than the U.S., making it the highest in the world.

Overall, in 2022, the ARPU of Japanese gamers was $418.99, well ahead of the global average of $64.66, the bulk of which comes from IAPs. By the end of 2025, it is expected to reach $1,750 per gamer.

Why is Japanese game localization necessary to win Japanese gamers?

Understanding consumer preferences is key to market success, and language plays a pivotal role. Research shows that most consumers and gamers strongly favor content in their native language.

In fact, according to CSA Research, 65% of consumers strongly prefer to consume content in their native language, while 40% will not buy a product that isn’t in their language.

The gaming community reflects similar trends. Studies reveal a strong cultural preference for playing games in native languages, with surveys indicating that between 36.4% and 72.3% of gamers prefer localized games, depending on the phrasing of the questions.

Beyond studies, the Japanese gaming community has actively voiced its demand for localized content. Last year, gamers compiled a list of over 150 international games they wished to see localized into Japanese. That list has since grown to 481 titles, with community members even contributing financially to translation projects to expedite the process.

Given these factors, Japanese game translation and localization not just a strategy for accessibility but a critical step toward increasing purchase intent, fostering player engagement, and amplifying word-of-mouth success within the market.

Japanese game localization challenges

Localizing a game for the Japanese market brings several challenges: technical, linguistic, cultural, and regulatory.

Technical challenges

String length

Due to its double-byte nature, translating from Latin script to Japanese can lead to spacing issues. Japanese writing systems—kanji, hiragana, and katakana—often require more character length to express the same meaning.

These differences require finding linguistic compromises or adjusting the game’s user interface (UI).

Line spacing

Unlike English, Japanese requires more line spacing, which should be considered during localization.

The Japanese keyboard

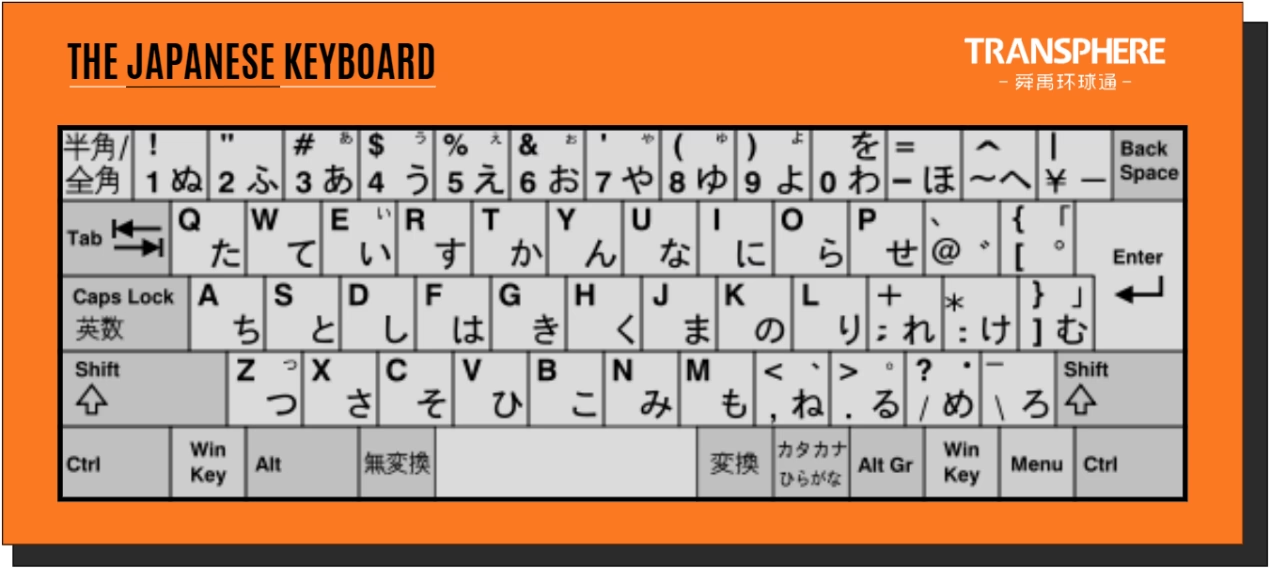

Japanese keyboards and input methods present distinct challenges, particularly when games don’t properly account for different keyboard layouts and input preferences.

These differences must be considered when mapping game controls to specific keys:

- Physical key position differences: The “@” symbol’s location (next to “P” instead of above “2”) can lead to unintuitive control schemes when games assume a US layout.

- Input method switching: Japanese users frequently switch between romaji and kana input methods using adjacent keys. Games that bind controls to these keys without considering this behavior can disrupt the player’s normal typing habits.

- Function key utilization: F6-F10 keys are regularly used for input conversion:

-

- F6: Hiragana

-

- F7: Full-width Katakana

-

- F8: Half-width Katakana

-

- F9: Full-width alphanumeric

-

- F10: Half-width alphanumeric

When games hardcode controls without accounting for regional keyboard differences, it can create a frustrating user experience. Players must choose between maintaining their preferred input method or adapting to potentially awkward control schemes.

Linguistic challenges

One of the main challenges during Japanese game translation is due to the language’s strict grammatical rules based on the relationship between the speakers. For instance, there are key differences between how different genders typically communicate.

Men’s language (だんせいようご,男性用語)

It is more direct and assertive, often using straightforward expressions. For example, when it comes to first-person pronouns, it is common to use “俺 (ore)” or “僕 (boku)” for “I.” Furthermore, sentence endings like “だ,” “ぜ,” or “ぞ” add strength to the tone. For example:

- 行くぜ(いくぜ) → “Go!”

- 俺は大丈夫だ(おれはだいじょうぶだ)→ “I’m all right.”

- 俺はそう思うぜ(おれはそうおもうぜ)→ “I think so.”

Women’s language (じょせいようご,女性用語)

It is softer and more polite, aiming to express humility and grace. For instance, first-person pronouns are usually “私 (watashi)” or “あたし” for “I.” Sentence endings like “わ,” “のよ,” or “かしら” create a gentler feel. For example:

- 行くわ(いくわ)→ “Go.”

- 私は大丈夫よ(わたしはだいじょうぶよ)→ “I’m all right.”

- 私はそう思うのよ(わたしはそうおもうのよ)→ “I think so.”

Additionally, the language further changes based on the status and relationships of the speakers. As such, Japanese has polite and casual forms.

Polite form – 敬体 (けいたい/keitai)

- 尊敬語 (そんけいご/sonkeigo): Used to express respect for the other party.

- 謙譲語 (けんじょうご/kenjōgo): Used to express self-deprecation and elevate the status of the other party.

- 丁寧語 (ていねいご/teineigo): Polite forms of common expressions that conclude with “です” (desu) or “ます” (masu).

Casual form – 常体 (じょうたい/jyoutai)

Used for daily communication, with a more natural and casual tone, suitable for occasions between family, friends, or peers.

In everyday life, younger people use polite forms when speaking to older individuals but use casual forms with peers and friends.

In the workplace, even an older subordinate must use polite speech when addressing a younger superior during work. However, casual forms might be used in non-work settings.

High-quality expectations

Perfectionism is central to the Japanese gaming market, where any lack of polish can erode trust in the product and its creators.

In fact, according to Niko Partners, Japanese gamers value high-quality, detail-oriented designs. They tend to gravitate towards traditional franchises with high-reliability expectations rather than novel IPs.

Moreover, Japanese users are heavily influenced by product reputation and popularity. Marketing materials should emphasize milestones, such as “Top 1 Downloads,” and celebrate achievements through app icons and updates to appeal to this perfectionist audience.

Regulatory challenges

In Japan, certain themes in video games are considered problematic, and game content is often subjected to strict regulations and censorship.

As such, Japanese game localization often involves modifying content to avoid religious depictions, tobacco products, or drug use, which are likely to draw the attention of regulatory bodies.

In fact, Japanese game ratings and censorship practices aim to reduce graphic violence and explicit content, particularly when it comes to sexual themes. For instance, games with Japanese translations, such as “The Last of Us” and “Cyberpunk 2077,” have undergone significant modifications to tone down depictions of nudity and violence.

While Japan has no official gaming curfew, guidelines recommend limiting online gaming time for minors. Additionally, games with extreme violence, such as Gears of War, Call of Duty, Grand Theft Auto, and Dead Island, are often edited to adhere to local censorship standards during Japanese game localization.

Sometimes, two game versions can be released: a censored version and a “bloody” version. Interestingly, the uncensored versions tend to sell better, though they receive the strictest “Z” rating for 18+ players.

Dr. Serkan Toto, a Tokyo-based analyst, noted on Twitter that Japan’s game censorship has become stricter since the introduction of the CERO rating system in 2002. Titles like “Uncharted 1,” “The Witcher 3,” and “Grand Theft Auto V” have also been modified for Japanese audiences.

An additional red line in Japan’s game censorship involves nuclear weapons. For instance, the “Fat Man” nuclear weapon launcher in “Fallout 3,” named after the atomic bomb dropped on Nagasaki, was modified for the Japanese release due to the understandable sensitivity surrounding the topic.

Key takeaways

Japanese game localization unlocks a substantial gaming market of at least 58 million gamers. Furthermore, Japanese gamers are among the most profitable worldwide, with a forecasted ARPU of $1,750 per year. Japan’s sheer scale and spending power make It the third-biggest gaming market in the world.

That being said, Japanese gamers are also among the most demanding and require highly polished games that suit their taste. Common localization pitfalls include linguistic errors, technical issues and the lack of cultural adaptation. As such, the localization process must be handled with care and done by professionals.